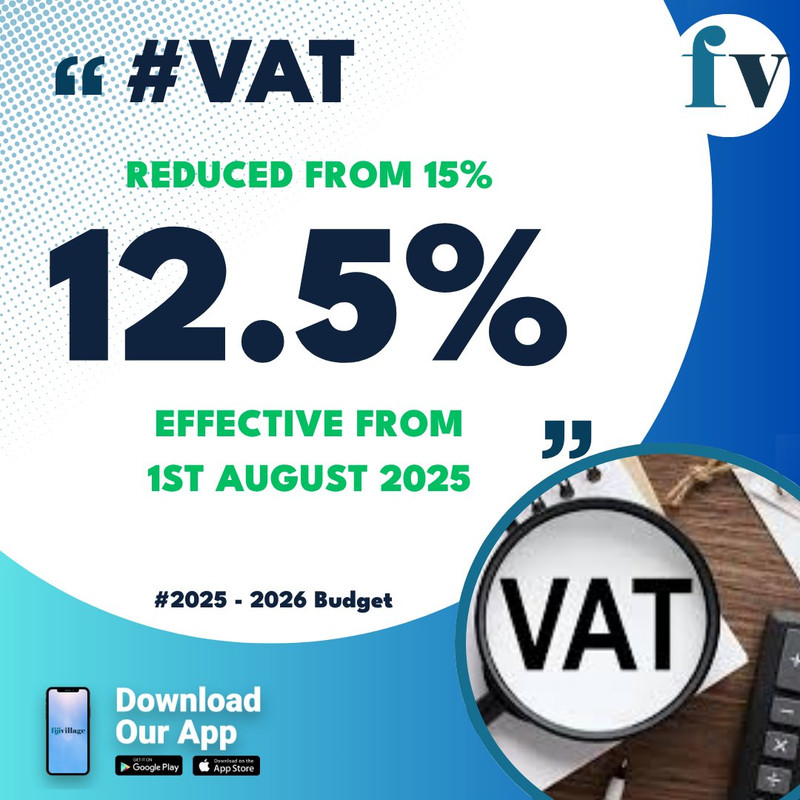

Good news for people as Deputy Prime Minister and Minister and Finance, Professor Biman Prasad has announced a number of measures in the 2025/2026 National Budget to address cost of living which include VAT to be reduced from 15% to 12.5%, civil servants pay to be increased, duty protections to be removed and more assistance to people on welfare programs.

The reduction in VAT from 1st August 2025 will deliver tax relief of $250 million to people.

This is in addition to the $250 million in relief through the zero-rated VAT on the 22 essential items.

Professor Prasad says this is a total of $500 million in VAT relief.

With heavy tariff protections, Professor Prasad says inefficiencies creep in and there is lack of incentives to bring down prices.

Tariff on chicken portions and offals (giblets, liver) which used to receive 42% protection will be reduced to 15%.

Fiscal duty on frozen fish, including salmon is reduced from 15 to 0%, similar to canned fish, like salmon and sardines.

Imported fruits and vegetables - tomatoes, cabbage, lettuce, cucumber, eggplant, pumpkin, banana, avocadoes, mandarins, watermelons and pawpaw will continue to attract 5% duty.

Apples, carrots, grapes, oranges, pears, celery, capsicums, mushrooms, kiwifruits, cauliflower, broccoli, nuts, etc not available in Fiji will continue to attract zero duty.

Potatoes, garlic, onion, tea, cooking oil will continue to attract zero duty.

Duty on lamb products which was reduced to zero percent will continue.

The reduced 15% duty for beef, ducks, corned mutton, corned beef and canned mackerel will continue.

The 5% duty will be maintained on dairy products like liquid milk, powdered milk, yogurt, cheese and butter.

These products used to receive 32% protection under the previous Government which provided a 10-year exclusive tariff arrangement to one private company.

Now anyone can import these dairy products at 5%.

Professor Prasad says they need the business community to support Government and pass these reductions to the people.

He says this support is meant for the consumers, and it is unjust and unethical for businesses to pocket these reductions.

FCCC, Consumer Council, FRCS and the Ministry of Finance will monitor prices closely on the ground.

This taskforce, where necessary, will propose immediate policy response measures like imposition of price controls on new items.

They will look at reductions or even removal of tariff protections provided to our local manufacturers and producers who are unreasonable with pricing.

There will also be fines to ensure compliance with the law.

The Government is also actively working with BAF to open import pathways for key food products.

Fiji is presently able to import whole frozen chicken only from New Zealand, even though there are countries producing competitive and safe poultry products.

Ghee, a staple item in many Fijian households, cannot currently be imported from India.

The restrictions have contributed to higher food prices and reduced consumer choice.

The goal is to introduce more competition into our supply chains, and reduce reliance on a few suppliers.

All social welfare recipients and Government pensioners will receive a 5% increase in their monthly allowances.

This is in addition to the across-the-board 15% increase they were provided in the last budget.

A total funding of $220 million is provided, an increase of $10 million.

Aftercare Fund members will receive a $0.8 million increase in their medical allowance only.

All civil servants will receive a 3% pay rise from August 2025.

This is in addition to the 7 to 20% increase provided in the last budget.

This is a direct cash injection of $115 million into household incomes, $85 million from last year’s increase and $30 million in this budget.

This means that civil servants would have received a total salary increase of between 10 to 23% pay rise within a year.

A 10% bus fare subsidy will be provided for all Fiji citizens for a 12-month period starting from August 2025 to July 2026 at a cost of around $10 million.

This means that every individual travelling by bus will now pay 10% less in fares.

The bus companies will still receive the current regulated fares as Government will pick up the 10% cost.

Students will continue to travel to school for free with blue cards.

The 50% subsidy will continue for all other students with an increased budget of $50 million.

The $200 Back-to-School Assistance will continue and will be paid in January 2026.

$40 million has been allocated to this.

With this, over $170 million would be provided through the back to school policy.

New initiative to support farmers and leaseholders earning less than $50,000 a year to receive a lease premium subsidy of 30% or up to a maximum of $7,500, for lease renewals.

To support landowners, the Committee on Better Utilisation of Land (CBUL) initiative is restored.

This will provide an additional 4% lease rental payment to the landowners taking it to a total of 10% of the Unimproved Capital Value.

Support will also be provided to the TLTB with funding to develop access roads to TLTB leases making it more accessible and productive.

Around $9 million is provided for this.

$4 million will be provided to support the reinstated FNPF pension payment for those pensioners affected by the 2012 pension reforms.

$25 million is provided for free water, free medicines and 50% electricity subsidy.

The cost-of-living package by the Coalition Government in this budget amounts to over $800 million in direct support.

Click here for Budget 2025-2026 stories, documents and details

Stay tuned for the latest news on our radio stations